Credit Rules – O2Vend Guide

The Credit Rules feature in O2Vend allows businesses to define how long customers can take before completing their payments.

This helps automate credit day limits, return timelines, and customer payment tracking, improving financial control and customer management.

Credit Rules

A credit rule determines the number of days a customer is allowed to delay payment after a purchase — often referred to as credit days.

It can also represent the allowed time frame for returns or exchanges (e.g., 7-day or 10-day return policy).

By setting credit rules, businesses can:

- Define flexible payment terms for customers.

- Manage return periods efficiently.

- Automate reminders and due-date tracking.

- Reduce manual follow-ups and credit-related errors.

How to Create a Credit Rule in O2Vend

Follow the steps below to configure a new credit rule:

- Open the Back Office.

- Navigate to Settings → Users → Credit Rules.

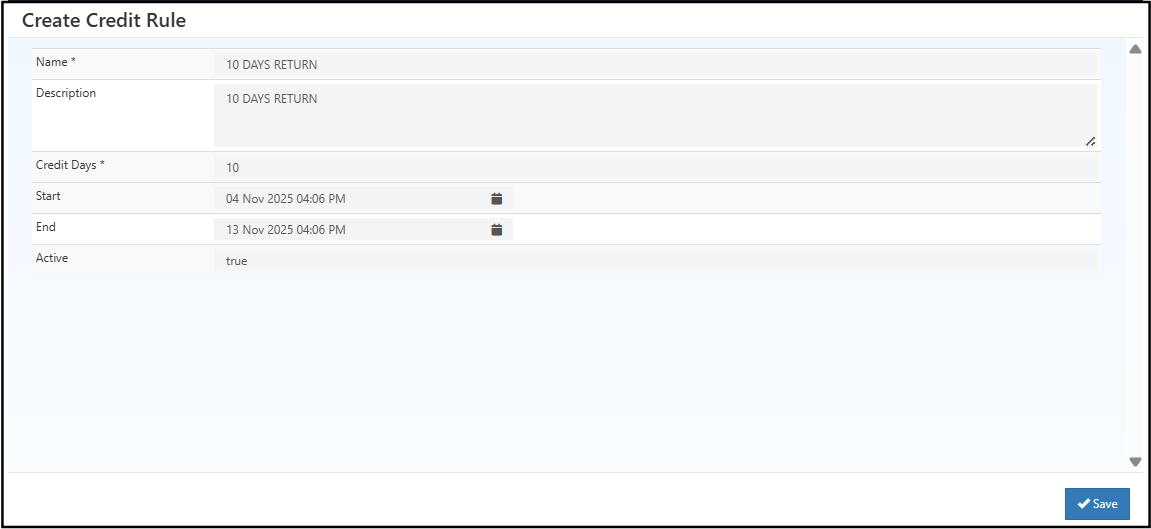

- Click the Create Credit Rule button.

- Enter the following details:

- Rule Name – A descriptive name (e.g., 7-Day Credit or 10-Day Return Policy).

- Credit Days – Specify how many days the customer has before payment or return.

- Description – Add additional notes or conditions, if needed.

- Click Save to store the rule.

Assigning Credit Rules to Customers

Once a credit rule is created, it can be assigned directly when creating or editing a customer:

- Go to Customers → Create / Edit Customer.

- In the Credit Rule field, select the rule from the dropdown list.

- Save the changes to apply the credit rule to that customer.

This ensures each customer follows the correct payment term or return policy based on their assigned rule.

Example Use Case

- 7-Day Credit Rule: Customers must complete payment or return items within 7 days.

- 10-Day Credit Rule: Extended credit for 10 days before payment is due.

These rules help streamline accounts receivable, manage customer relationships, and enforce store policies automatically.