O2VEND Cash Book Report | Track Daily Cash, Prevent Errors & Export GST-Ready

Prevent cash mismatches and reconciliation errors.

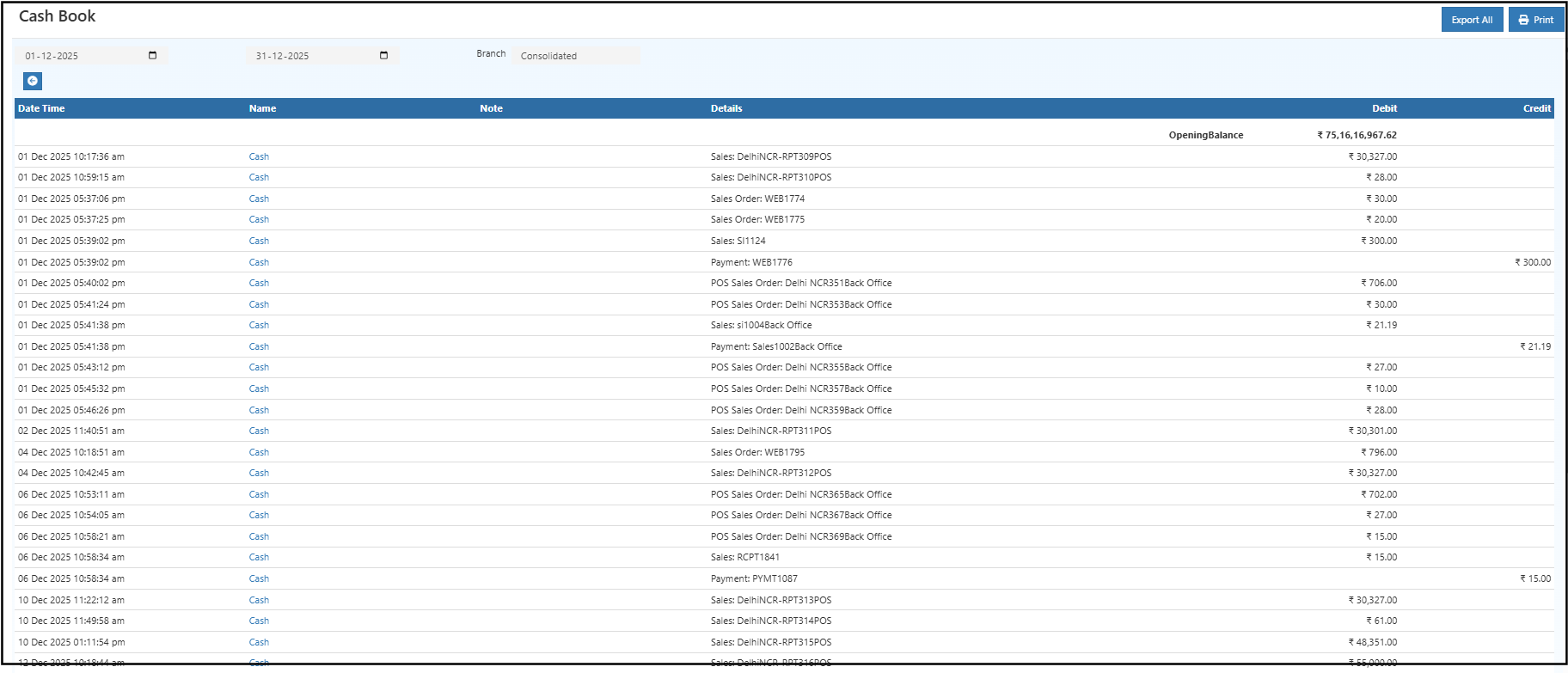

The Cash Book Report in O2VEND ERP tracks every cash transaction in real time, provides accurate closing balances, and generates GST-ready reports—ideal for retail, POS, and multi-store operations.

- ✔ Monitor all daily cash inflows and outflows

- ✔ Verify opening & closing balances instantly

- ✔ Export GST-compliant Excel or PDF reports

- ✔ Reduce financial discrepancies and manual errors

Explore Cash Book Report in O2VEND →

Problem Statement

Daily cash management challenges:

- POS and ledger cash not matching

- Missing or duplicate receipts/payments

- Time-consuming manual reconciliation

- Difficulty staying GST-compliant

👉 Without a clear Cash Book, small errors become accounting headaches.

✅ Benefits of Cash Book Report

- ✔ Real-time visibility of cash receipts and payments

- ✔ Instant opening & closing balance verification

- ✔ Simplified reconciliation with POS and bank records

- ✔ GST-ready reports for audits

- ✔ Consolidated view for multi-branch operations

📘 What Is a Cash Book?

A Cash Book is a daily ledger recording all cash transactions—receipts, payments, deposits, withdrawals—chronologically.

Purpose: Daily snapshot of cash flow for accurate reconciliation and audit compliance.

How to Use Cash Book Report in O2VEND

- Login to O2VEND Back Office

- Go to Reports → Account Books → Cash Book Report

- Set Start Date and End Date

- (Optional) Filter by Branch or Cash Account

- Review daily transactions:

- Debit → Payments / Outflow

- Credit → Receipts / Inflow

- Closing Balance → End-of-day cash total

- Export or Print

- Export All → Excel/CSV

- Print → PDF for audits or GST filing

💡 Tip: Daily review prevents cash mismatches and ensures smooth audits.

🧾 Key Features

| Feature | Benefit |

|---|---|

| Accurate cash tracking | Record all receipts, payments, and petty cash in one view |

| Daily & monthly summaries | Quick snapshot of opening, debit, credit, and closing balances |

| Branch-level reporting | Consolidated or individual branch cash view |

| Export to PDF / Excel | Easy reconciliation, audits, and GST filing |

| Real-time data | Track cash inflow/outflow instantly |

Related Reports

- Ledger Report – Track account-level entries

- Day Book – Daily transaction summary

- Cash Book Report – Track daily cash accurately

- Outstanding Report – Monitor receivables & payables

- Payment Methods Setup – Configure payment gateways

- Receipt Report – Track all receipts for sales & payments

- Sales Book – Monitor daily sales transactions

- Location Summary – Overview of stock per location

Frequently Asked Questions (FAQ)

Can the Cash Book be filtered by branch or cash account?

Yes, filters allow consolidated or branch-level cash views.How is closing balance verified?

End-of-day Closing Balance shows total cash available and must match POS and bank deposits.Is the report GST-compliant?

Yes, all exports are GST-ready and audit-compliant.Can daily cash reports be exported?

Yes, use Export All (Excel/CSV) or Print for PDF statements.

Need Help with Cash Book Reports?

Guidance for tracking daily cash, reconciling transactions, and generating GST-compliant reports in O2VEND ERP.

Contact Support →Manage Cash Flow Easily with O2VEND

Track daily cash, reconcile payments, and export GST-ready cash book reports confidently.