How to Generate & Download GSTR-1 JSON in O2VEND (Step-by-Step GST Filing Guide)

Generate the GSTR-1 Report in O2VEND with complete B2B, B2C and HSN summary and download GST-ready JSON instantly. This report helps businesses prepare accurate monthly or quarterly GST returns with structured outward supply data.

The GSTR-1 Report automatically compiles taxable value, GST amount, invoice classification and HSN details into a filing-ready format. Review totals, validate tax data and export JSON for smooth GST portal upload.

Designed to support accurate GST compliance and simplified return preparation.

What is GSTR-1 Report in O2VEND?

The GSTR-1 Report is a GST outward supply summary that consolidates sales invoice data for a selected period.

It categorizes transaction data into:

- B2B Invoices (Registered Customers)

- B2C Large Invoices

- B2C Other Invoices

- Nil Rated / Exempt Supplies

- Credit & Debit Notes

- HSN-wise Summary

- Total Taxable Value & GST Amount

The report can be generated at branch level or consolidated level, making it suitable for single and multi-branch businesses.

Why GSTR-1 Report Is Important for GST Filing

Accurate GSTR-1 filing requires structured and validated outward supply data. This report ensures all sales transactions are properly summarized before submission.

- Maintains GST compliance

- Eliminates manual tax calculation errors

- Improves reconciliation accuracy

- Classifies invoices automatically (B2B/B2C)

- Keeps audit-ready documentation

Why use this report?

- Prepare monthly GSTR-1 return

- Download GST JSON file for portal upload

- Cross-check invoice tax totals

- Validate HSN-wise turnover

- Review branch-wise outward supply data

How to Access the GSTR-1 Report

Navigation Path:

Back Office → Reports → Miscellaneous → GSTR-1

After opening the report:

- Select required Date Range

- Choose Branch or Consolidated

- Review invoice summaries

- Click Export JSON to download GST-ready file

How to Download GSTR-1 JSON File in O2VEND

To generate GST portal upload file:

- Open Back Office

- Navigate to Reports → Miscellaneous → GSTR-1

- Select filing period (Monthly / Quarterly)

- Verify B2B, B2C and HSN summary

- Click Export JSON

- Upload the generated file to the GST portal

This ensures smooth GST return filing without manual data preparation.

Filters & Controls

The report includes:

- Date Range Filter – Select month, quarter or custom period

- Branch Selection – View specific branch or consolidated data

- Export Options – Export All / Export JSON

These filters help generate accurate outward supply data for the selected filing period.

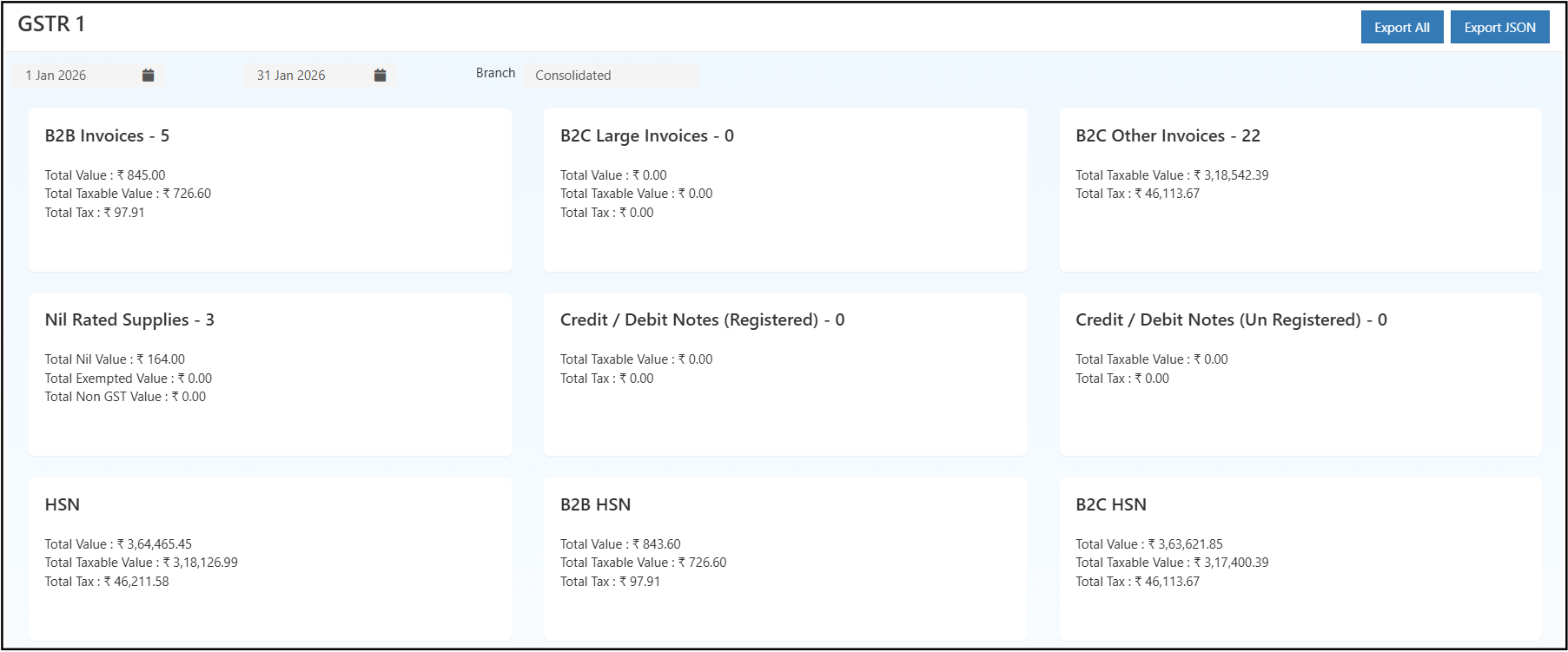

GSTR-1 Report View Explained

The dashboard displays categorized GST sections in structured summary cards.

Summary Sections

- B2B Invoices – Registered customer sales with GST breakup

- B2C Large Invoices – High-value unregistered transactions

- B2C Other Invoices – Retail sales summary

- Nil Rated Supplies – Exempt or non-taxable transactions

- Credit/Debit Notes – Sales adjustments

- HSN Summary – HSN-wise taxable value and tax totals

Each section shows:

- Total Value

- Total Taxable Value

- Total GST Amount

This layout supports quick validation before GST filing.

Invoice Verification

The GSTR-1 Report allows invoice-level verification:

- Review detailed invoice data

- Validate tax breakdown per invoice

- Identify discrepancies before export

This minimizes filing corrections and improves submission accuracy.

How to Use the GSTR-1 Report Effectively

- Generate report for current filing month

- Compare totals with Sales Register

- Verify tax summary using Tax Summary Report

- Validate HSN breakup

- Download JSON file

- Upload to GST portal

For cross-verification, refer to:

Common Usage Scenarios

- Monthly GST return filing

- Quarterly GST submission

- Branch-wise tax reconciliation

- Internal audit preparation

- HSN turnover validation

Business Benefits

Accurate GST Compliance

Auto-classified outward supply data ensures structured filing.

Faster JSON Export

Generate GST-ready file instantly for portal submission.

Better Tax Visibility

Clear breakdown of B2B, B2C and HSN data improves financial monitoring.

Who Should Use This Report?

- Accountants

- GST Filing Executives

- Finance Managers

- Business Owners

- Auditors

Frequently Asked Questions (FAQs)

1. Can GSTR-1 JSON be downloaded directly from O2VEND?

Yes. The Export JSON option generates GST portal-ready file.

2. Does the report include HSN summary?

Yes. HSN-wise taxable and GST amounts are included.

3. Can data be viewed branch-wise?

Yes. Branch or consolidated view is available.

4. Can past filing periods be accessed?

Yes. Date range filter allows selection of previous months or quarters.

Export Options

- Export All – Downloads complete structured report data

- Export JSON – Generates GST-compliant JSON file

These export options support smooth GST portal upload and documentation.