How to Manage Credit Notes in O2VEND – Return Orders, Refunds & Restocking Guide

This guide explains how to manage Credit Notes in O2VEND, covering return order processing, refund handling, inventory restocking, product return tracking, and financial reconciliation.

Learn how to create and approve credit notes, attach supporting documents, restock returned items into the warehouse, and track every step of the return workflow for accurate accounting and audit compliance.

What is a Credit Note?

A Credit Note is a financial document issued when a customer returns products or when an invoice needs correction. It reduces the billed amount, updates stock, and records the refund or credit adjustment.

What is O2VEND Return Management?

O2VEND’s Return Order Management System provides a complete product return tracking system, refund processing, and inventory restock workflow. This guide explains how to manage credit notes, refunds, and returns across both POS and E-commerce channels.

Table of Contents – O2VEND Credit Note Guide

- Overview

- What is a Credit Note?

- O2VEND Return Management

- Credit Note Screen Overview

- Return Order Management System – Lists Overview

- Credit Note Workflow – How to Process a Credit Note

- Credit Note Tabs Overview

- Product Table – Returned Product Details

- Right-Side Action Panel

- Inventory Restock Process for Returned Products

- Goods Received (GRN)

- Credit Note Details

- Edit Credit Note

- Exporting Credit Notes

- FAQ – Credit Note & Return Order Management

Credit Note Screen Overview

The Credit Note screen provides a complete view of:

- Customer information

- Return values and adjustments

- Product-level changes

- Logistics and workflow statuses

- Internal notes

These fields improve transparency, audit preparation, and financial reconciliation across the O2VEND Return Management System.

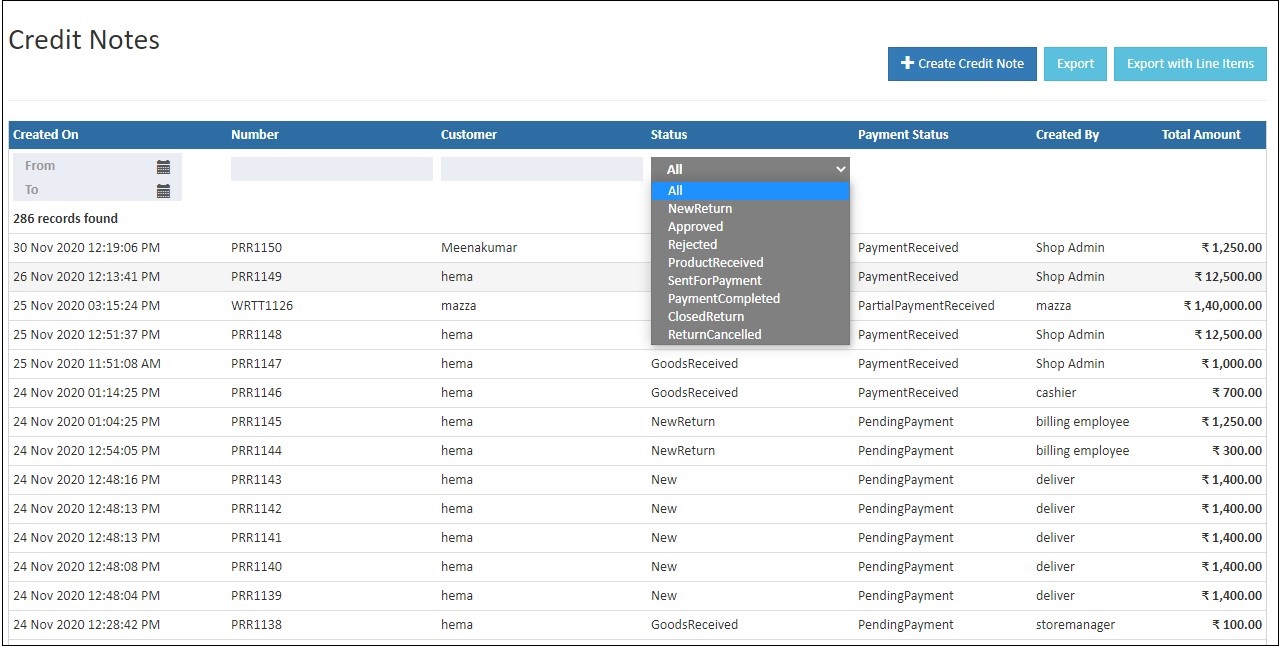

Return Order Management System – Lists Overview

The page contains a list of all returns.

Number

This is a unique number for a credit note.

Status

A Return Order Workflow tracks every stage of a product return—from creation, approval, product receipt, refund processing, to closing the return request. It ensures accurate auditing and stock reconciliation.

Credit Note Status

Status helps to view all the return orders status like-new return, approved, etc.,

Product Return Tracking System – Status Types

Product return tracking monitors every step of a return—creation, approval, receipt, refund, and restocking—to ensure accurate stock and financial reconciliation.

These status types help track every stage of the product return workflow, from creation to refund completion.

- New Return – The return order is created.

- Approved – Admin accepts the customer’s return request.

- Rejected – The return request cannot be processed.

- Product Received – The returned product is received.

- Sent for Payment – Refund is initiated.

- Payment Completed – Refund is fully processed.

- Closed Return – Customer no longer wants to return.

- Return Canceled – Customer cancels the return request.

Customer

The Name of the ordered customer is stored in a customer field(The Order Placed by whom).

Created On

The order created date will show in a created on the field.

Total

The Customer total amount will show in an order total.

How to Process a Credit Note (Credit Note Workflow Steps)

Credit Note Creation is the process of recording a customer product return, selecting items and their quantities, entering pricing and tax details, and generating the financial adjustment for refunds or store credit.

Go to the Voucher in the Back Office and select the CreditNote. The admin can select the customer from the list of customer in the dropdown and select the quantity of the product. These steps form the complete credit note workflow inside O2VEND.

Note

How to Create a Credit Note?

Select the branch, choose the customer, add returned items, review totals, and save the Credit Note to finalize the return process.

Steps to Create a Credit Note

- Click Create Credit Note on the top right.

- Select the Branch where the return is processed.

- Choose the Customer from the search dropdown; customer details fill automatically.

- Add or update Billing and Shipping addresses if required.

- Search and add Products being returned, then enter the return quantity and price details.

- Review the Summary section at the bottom for totals, taxes, and adjustments.

- Click Save (or press Ctrl + S) to complete the credit note.

Credit Note Tabs Overview

The Credit Note screen contains multiple functional tabs. Each tab handles a specific part of the return process—customer information, payments, product receipt, approval workflow, financial mapping, vendor linkage, document storage, and action history.

The following section explains every tab in detail.

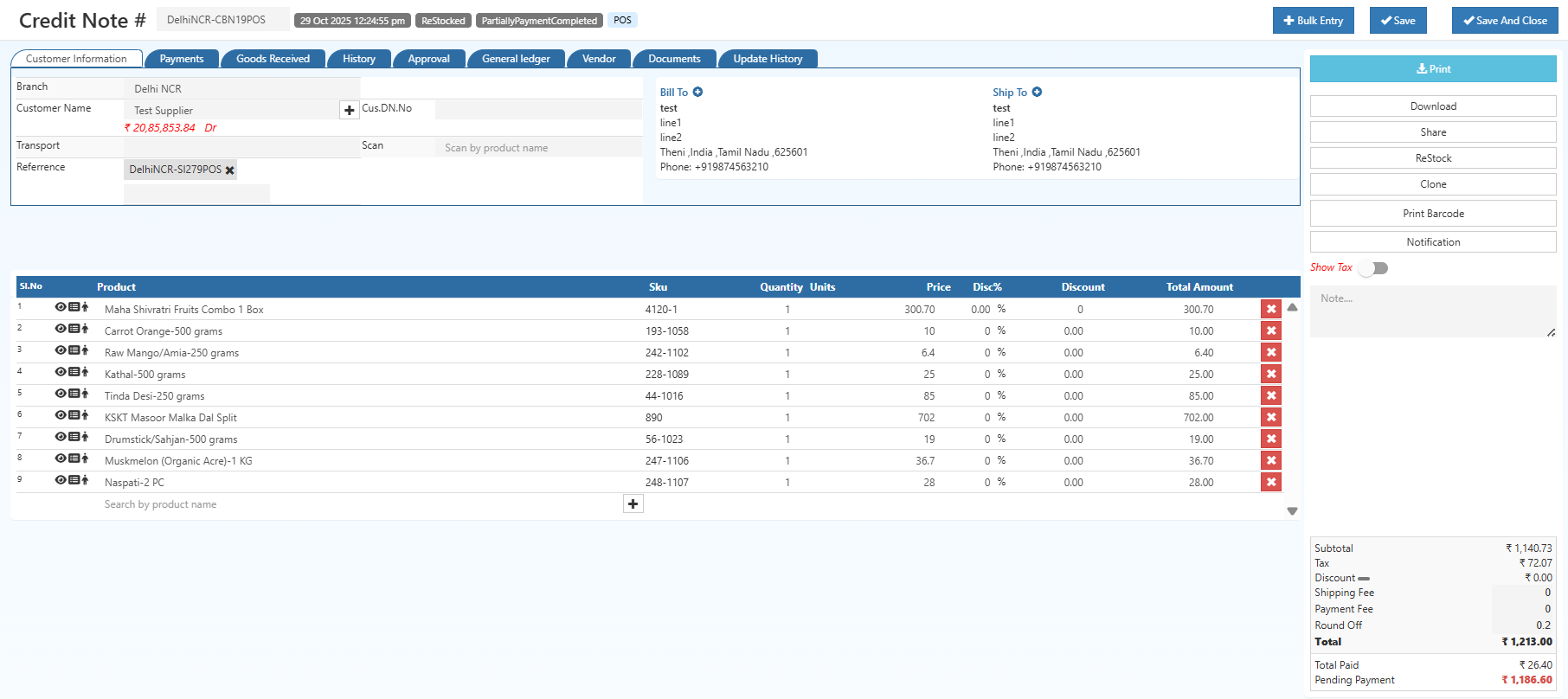

1. Customer Information Tab

Choose the customer from the dropdown; details populate automatically from the Customer Management Guide.

The Customer Information section captures essential details to identify the branch, customer, transport, and scanning method for returns. Each field ensures proper validation of credit notes and linking to the correct account. Fields & Explanation

- Branch - Shows the store or unit where the credit note is created. Ensures returns, refunds, and stock adjustments apply to the correct location.

- Customer Name - Displays the customer for the return. Automatically links the credit note to the customer’s profile, purchase history, and outstanding balances.

- Customer Balance - Shows the customer’s current balance. Cr indicates available credit, helping decide whether the credit note adjusts existing credit or future purchases.

- Cus. DN. No - Unique reference number for tracking credit adjustments. Links returns to original billing for accurate accounting.

- Transport - Specifies the return method—courier, delivery van, walk-in, etc.—for tracking logistics.

- Scan by Barcode/QR - Enables barcode/QR scanning for quick identification of SKU, batch, and quantity.

- Scan by Product Name - Alternative to scanning. Allows searching products by name when barcodes are unavailable.

- Reference - Stores internal/external references like website orders, marketplace IDs, delivery slips, or service requests for audit and verification purposes.

2. Payments Tab

This section is part of the refund workflow, ensuring accurate financial reconciliation. This tab captures refund, adjustment, or settlement details.

Fields & Explanation

- Payment Method – Records the mode used to settle the refund (Cash, UPI, Card, Bank Transfer, Store Credit).

- Refund Amount – Indicates the value refunded back to the customer.

- Payment Created on Date – Displays the exact date on which refund was processed.

3. Goods Received Tab

The Goods Received tab captures shipment details for inventory tracking and validation.

Fields & Explanation

- Created On - Date when the goods receipt entry was created.

- Shipment No./Party - Shows the shipment number or the party responsible for sending the goods.

- Number - Internal reference number for the goods receipt entry.

- Status - Current state of the goods receipt (Pending, Received, Partially Received).

- Location - Warehouse or branch where the goods are stored.

4. History Tab

The History tab tracks changes made to records for audit and reference purposes.

Fields & Explanation

- Date – Shows when the change was made.

- Status – Displays the updated status after the change.

- Changed By – Identifies the staff responsible for the change.

- Note – Contains optional notes related to each status update.

5. Approval Tab

The Return Approval Process tab is used to update and record the status of a transaction.

Fields & Explanation

- Change Status – Select the new status to apply (e.g., Approved, Rejected, Pending).

- Reason – Provide a reason or comment for the status change.

- Save – Click to confirm and save the status update along with the reason.

6. General Ledger (GL) Tab

The General Ledger tab shows all financial entries linked to transactions.

Fields & Explanation

- Date Time – The date and time when the ledger entry was created.

- Name – The type or title of the transaction.

- Party – The customer, vendor, or party involved in the transaction.

- Debit – Amount debited in the transaction.

- Credit – Amount credited in the transaction.

- Repost - Option to repost the entry if corrections are needed.

7. Vendor Tab

This tab appears only when the credit note is linked to vendor-based orders.

Fields & Explanation

- Vendor Name – Vendor connected to the returned product.

- Vendor Invoice No. – Reference invoice issued by the vendor.

- Restock Source – Identifies whether the return is internal or vendor-based.

8. Documents Tab

Stores all files related to the credit note.

Fields & Explanation

- Upload Section – Allows attaching invoices, photos, return proofs, courier slips, and damage images.

- File Name & Type – Displays the list of uploaded files.

- Download / Preview – Opens or downloads attachments.

- Delete – Removes documents if not required.

History

The audit history supports the product return tracking system for compliance.

- Created On - Date and time when the change entry was created.

- Updated By - User who made the changes.

- Actions - Details of what was changed, including old and new values. Common changes include:

- createdOnValue – Timestamp of creation.

- subtotal – Total before tax.

- taxAmount – Tax applied to the order.

- orderTotal – Total order amount including tax.

- orderItems – List of items in the order and their quantities (if updated).

10. Bulk Entry

Allows mass entry of returned products for large credit notes.

Fields & Explanation

- CSV/Excel Upload – Imports multiple return items using a template.

- Bulk Product Selector – Helps select multiple SKUs at once.

- Quantity Column – Used to specify the return quantity for each product.

2. Product Table

This section lists every returned product and shows all stock and financial adjustments. Search and add products being returned, then enter quantities and price details. For product setup instructions, see the Product Setup Guide.

Product / SKU

- Displays product name and SKU.

- Accurately identifies which item is being returned.

Returned Quantity

- Number of units returned by the customer.

- Affects stock re-entry.

Unit Price

- Original per-unit selling price.

- Used in refund calculation.

Discount Applied

- Displays item-level discount applied during original sale.

- Ensures correct refund of discounted value.

Tax (GST/IGST/CGST/SGST)

- Shows applicable tax components.

- Tax values are reversed when a credit note is issued.

Right-Side Action Panel

The right-side panel contains all functional actions related to managing a Credit Note.

Every button has a unique operational purpose, allowing staff to print, download, restock, track finance, share documents, and manage tax visibility.

This section explains each action in detail, including how it works, when it is used, and what impact it has on accounting and operations.

The Print option generates a print-ready version of the Credit Note document.

This version includes customer information, product details, tax calculation, return reason, and financial summary.

It is used when a physical document is required for warehouse approval, customer acknowledgement, finance auditing, or delivery personnel references.

Download (PDF)

The Download action exports the entire Credit Note as a PDF file.

This ensures a permanent, non-editable digital copy for audit trails, GST compliance, email communication, and customer service records.

The downloaded PDF carries company branding, invoice metadata, product return lines, tax breakup, and restock information.

Share

The Share option enables sending the generated Credit Note via digital communication channels such as email, WhatsApp (if integrated), or internal messaging tools.

This feature helps customer service teams quickly send confirmations to customers, logistics staff, or finance departments without manual downloading and attaching.

Restock

This module is central to the inventory restock process during product returns. The Restock section allows adding the returned items back into inventory.

When opened, it displays product details such as SKU, product name, and return quantity.

The user can select:

- Warehouse

- Rack or shelf location

- Lot or batch number

- Manufacturing and expiry dates (if applicable)

This ensures correct inventory Stock reinstatement, stock traceability, and quality inspection logging.

Clone

The Clone action duplicates the entire Credit Note, including customer information and product lines.

It is typically used when multiple return documents are required for the same customer, when partial returns are processed across separate visits, or when the same correction needs to be applied across related orders.

Print Barcode

The Print Barcode action generates barcode labels for returned or restocked stock.

It is helpful for warehouse teams who need to re-label:

- Repacked items

- Items returned from customers

- Lot-tracked inventory

- Shelf or storage updates

This ensures proper scanning, fast picking, and accurate stock movement tracking.

Notification

The Notification tool triggers automated alerts about the Credit Note status.

Notifications can be used for:

- Informing customers about approval

- Notifying finance about refund processing

- Updating warehouse teams about item arrival

- Maintaining internal communication logs

Show Tax (Toggle)

This toggle hides or displays tax-related values in the interface.

Useful when staff need a simplified view without GST, or when detailed analysis of tax breakup is required for reporting.

It can switch between:

- Tax-inclusive view

- Tax-broken-down view

This switch supports accounting accuracy and helps staff verify complex tax calculations.

Notes

The Notes section allows adding internal comments linked to the return.

Common uses include:

- Damage description

- Customer explanation

- Inspection findings

- Finance remarks

- Warehouse handling instructions

Notes do not appear on customer-print copies, maintaining internal privacy.

Inventory Restock Process for Returned Products

What is Restocking?

Restocking is the process of adding returned products back into inventory by selecting a warehouse, entering quantities, and assigning lot or batch details.

When a product return is approved and the item is received, the returned quantity can be restocked back into the Inventory Management Guide.

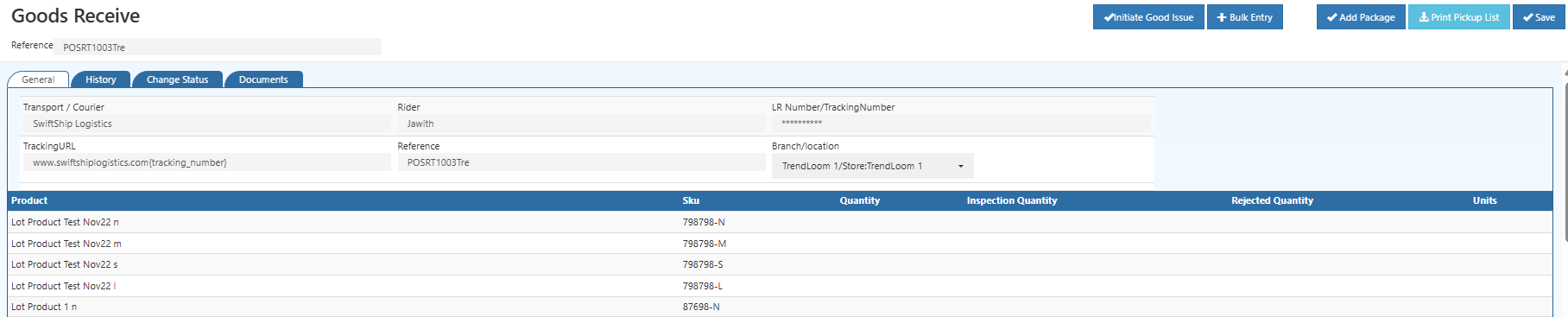

Goods Received (GRN)

Goods Received (GRN) is a confirmation entry showing that returned items have been physically received at the warehouse or store. It tracks shipment details, receipt dates, and storage locations.

For more details, please refer to the official documentation:

O2VEND Goods Receive Guide

How To Restocking Products into Inventory

- Click Restock. (For more details on Shipment section)

- The product name, SKU and quantity of the product will be shown.

- select Location (for more details on how to create Location-location section).

- Enter Restock Quantity(Some items need to Restock).

- Click Save button.

- The return of the product is restocked.

How to add lot in Restock

- Click Restock button.

- Click Allot Lot button for the products.

- Enter the lot number, manufacturer batch, mfg date, expiration date, and adjust the quantity for this product, or pick an existing lot number. After pressing the enter key, the information is stored.

- Click Save button. A lot is allocated, and the stock is added to the designated warehouse.

- Click Print Challan button to print goods return items.

Refer Goods receive section for more details.

Credit Note Details

This section contains general information of the credit note like customer information, address information, Payment and shipment method, note, status and total.

How to view credit note Details

- Open Back Office

- Go to Voucher Menu.

- Click and open Credit Note section.

- View All return List in the section.

- If click Number it moves to the order details page.

- Click Close button to go order list page.

Edit credit note

Edit credit note details for customer information and add the products.

How to edit credit note details

- Open Back Office

- Go to Voucher Menu.

- Click and open Credit Note section.

- View All List in the order section.

- If click Number it moves to the order details page.

- If want to edit customer information, enter customer name and add customer billing, shipping address.

- If want to add the products, enter a product name in a search by product name.

Tip

If click Download Invoice to download the PDF Order. It includes the details of company name, company logo, Address, customer order details.

Tip

Use Export Orders and Export Orders With Order Lines options to export the report details into a comma-separated CSV file.

FAQ – Credit Note & Return Order Management

1. How do I process a return order in O2VEND?

Open the Credit Note module, select the customer, add returned items with quantities, review totals and taxes, and save the Credit Note. This initiates the full return workflow including refund and restock.

2. How does the credit note approval process work?

Use the Approval Tab to update return statuses such as New Return, Approved, Rejected, Product Received, and Payment Completed. Each status change is logged in the History Tab for audit purposes.

3. How is inventory restocking managed?

Click the Restock button in the Credit Note, select the warehouse location, enter restock quantities, assign lot/batch numbers if needed, and save. This updates inventory and adds returned items back to the warehouse stock.

4. Can I attach documents to a credit note?

Yes. The Documents Tab allows uploading invoices, photos, courier slips, damage proofs, or any relevant files to support the return and refund process.

5. What is the GRN (Goods Received) section in O2VEND?

Goods Received (GRN) confirms that returned items have been physically received in the warehouse. For more details, refer to the Goods Received Note Guide.