Daily Tax Report in O2VEND – Monitor Day-wise Tax Liability Accurately

The Daily Tax Report in O2VEND helps businesses track tax amounts calculated on sales and returns for each day. It provides a clear breakdown of net sales and applicable taxes, making it essential for GST compliance and financial reconciliation.

What is Daily Tax Report?

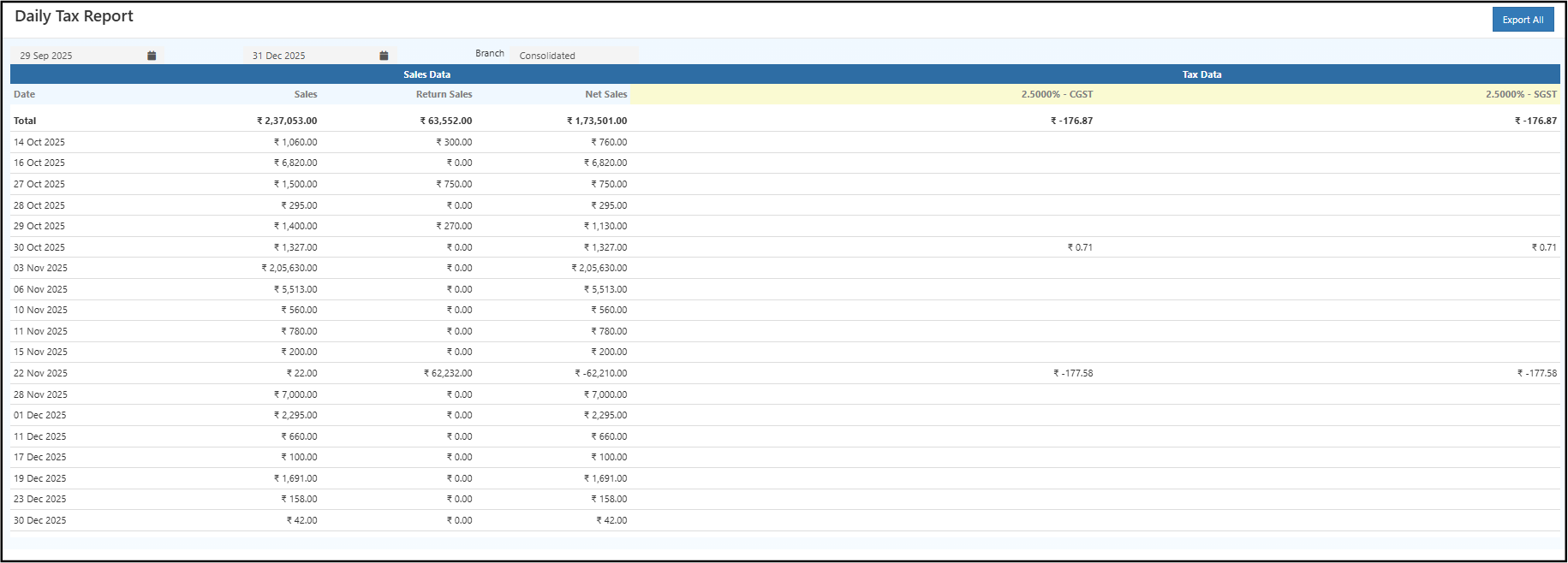

The Daily Tax Report summarizes day-wise sales, return sales, net sales, and corresponding tax values.

It presents tax data at a daily level, segmented by tax type such as IGST, CGST and SGST, ensuring transparent tax tracking.

- Summarizes daily sales and tax calculations.

- Displays tax breakup based on configured tax percentages.

- Supports branch-wise and consolidated views.

Why Daily Tax Report Is Important

This report plays a key role in taxation and compliance:

- Helps ensure accurate GST calculation on daily transactions.

- Supports statutory reporting and audit requirements.

- Identifies tax impact of sales returns.

- Enables easy reconciliation between sales and tax amounts.

Why use this report?

- Track daily GST liability accurately.

- Reconcile sales, returns, and net taxable value.

- Verify CGST and SGST amounts for each day.

- Prepare data for monthly or period-based tax filing.

- Audit unusual tax variations caused by returns.

How to Access the Daily Tax Report

Navigation Path: Back Office → Reports → Account Reports → Daily Tax Report

Filters & Controls

- Date Range: Select from and to dates to view tax data for a specific period.

- Branch: Choose a specific branch or view Consolidated data across branches.

Report View Explained

Summary Table

The summary table displays:

- Date: Transaction date.

- Sales: Total gross sales for the day.

- Return Sales: Value of returned items.

- Net Sales: Sales after deducting returns.

- CGST / SGST / IGST Columns: Tax amounts calculated based on configured tax rates.

A Total row at the top summarizes sales, returns, net sales, and tax amounts for the selected period.

Drill-Down Details

- Clicking on a specific date row allows users to cross-verify daily sales and tax figures with underlying transactions.

- This helps identify which day contributed to higher or negative tax values.

How to Use the Daily Tax Report

- Open the Daily Tax Report from the Finance reports section.

- Select the required date range.

- Choose branch-wise or consolidated view.

- Review daily sales, returns, and net sales.

- Verify CGST and SGST values for each day.

- Export the report for filing or audit purposes.

Common Usage Scenarios

- Accountants verifying daily GST calculations.

- Finance teams reconciling tax with sales reports.

- Business owners reviewing tax impact of returns.

- Preparing data for monthly GST returns.

Business Benefits

Improves tax accuracy by clearly showing daily taxable values and tax amounts.

Simplifies GST audits with transparent, date-wise tax reporting.

Reduces reconciliation errors between sales, returns, and tax liability.

Export Options

- Export All: Download the complete report in Excel or CSV format.