Additional Tax in O2VEND

Overview

The Additional Tax feature in O2VEND allows adding extra tax charges to invoices from the Back Office. This is useful for applying taxes other than standard GST, such as service charges, handling fees, or any custom tax defined by the business.

Once enabled and configured, the system automatically calculates and applies the additional tax during invoice generation.

Location in Back Office

Navigation Path:

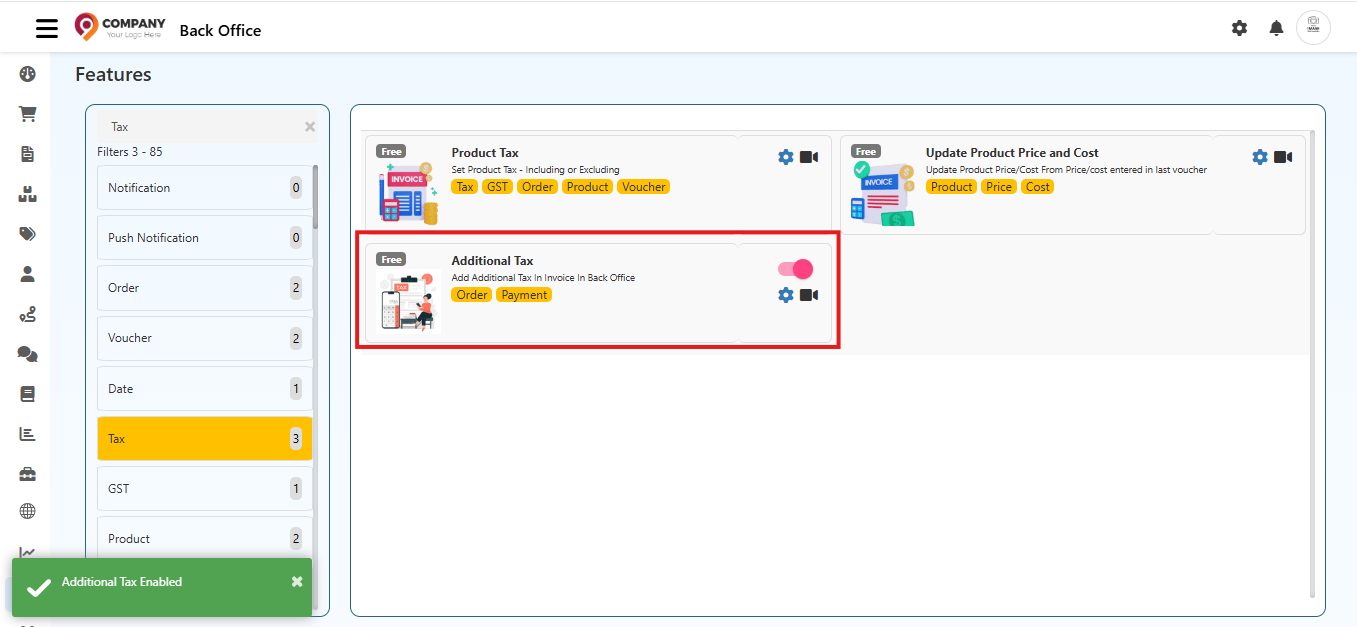

Back Office → Features → Tax → Additional Tax

Purpose of Additional Tax

The Additional Tax feature helps to:

- Apply custom tax percentages apart from GST.

- Maintain flexibility for business-specific tax requirements.

- Accurately reflect extra charges in invoices.

- Map additional taxes to proper accounting ledgers.

Enabling Additional Tax

- Navigate to the Additional Tax feature under Tax.

- Use the toggle switch to enable the feature.

- Once enabled, configuration options become active.

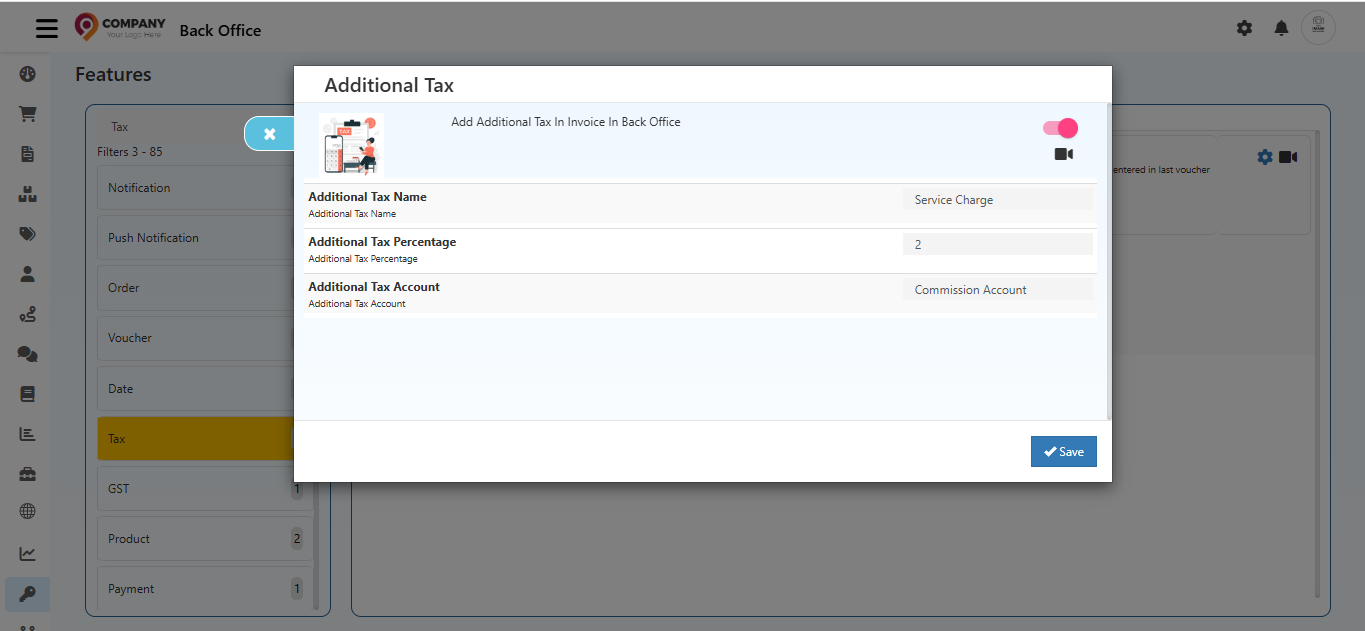

Configuration Fields

Additional Tax Name

- Defines the display name of the tax.

- This name appears on invoices and reports.

- Example: Service Charge, Packing Tax, Environmental Fee.

Additional Tax Percentage

- Specifies the percentage to be applied on the invoice amount.

- Accepts numeric values only.

- Example:

- Enter

2for 2%. - Enter

5for 5%.

- Enter

Additional Tax Account

- Selects the accounting ledger to which the tax amount is posted.

- Ensures accurate financial tracking and reporting.

- Ledger should be pre-created in Accounting Books.

Saving Configuration

- After entering all required details, click Save.

- The configuration is applied immediately.

- Additional Tax becomes active for applicable invoices.

How Additional Tax Works

- Additional Tax is calculated based on the configured percentage.

- It is applied along with other applicable taxes.

- The tax amount appears as a separate line item in the invoice.

- Accounting entries are posted to the selected tax account.

Example:

If the invoice amount is ?10,000 and Additional Tax is 2%, then ?200 will be added as Additional Tax.

Note

- Use clear and meaningful tax names like Service Charge or Environmental Fee.

- Double-check the tax percentage before enabling in production.

- Align tax accounts with accounting standards.

- Test invoices after configuration to ensure accuracy.