Daily Settlement Report Guide for Businesses

The Daily Settlement Report is an essential financial management tool for businesses. It enables accurate recording of daily sales, return transactions, net sales, credit sales, and payment data, while also supporting automated report generation. Scheduled reports enhance operational efficiency, reduce manual workload, and ensure timely delivery of financial insights across business branches.

The Daily Settlement Report consolidates all payment transactions within a specified date range or single day, offering a comprehensive overview of business performance and financial health. This report is particularly valuable for:

- Sales tracking and reconciliation

- Monitoring returns and net revenue

- Payment collection management

- Business performance analysis

- Automation of routine financial reporting

Pro Tip: Leveraging the schedule feature in O2VEND ensures that daily, weekly, or monthly reports are delivered automatically to relevant stakeholders, enhancing data-driven decision-making.

Key Features of Daily Settlement Report

- Daily Settlement Report: Provides full visibility into sales, returns, net sales, and payments.

- Automated Reporting: Reduces manual effort and ensures consistent reporting.

- Comprehensive Financial Tracking: Monitors credit sales, refunds, and overall revenue.

- Operational Efficiency: Scheduled reports improve workflow across departments.

- Data Accuracy & Compliance: Supports audit and taxation requirements.

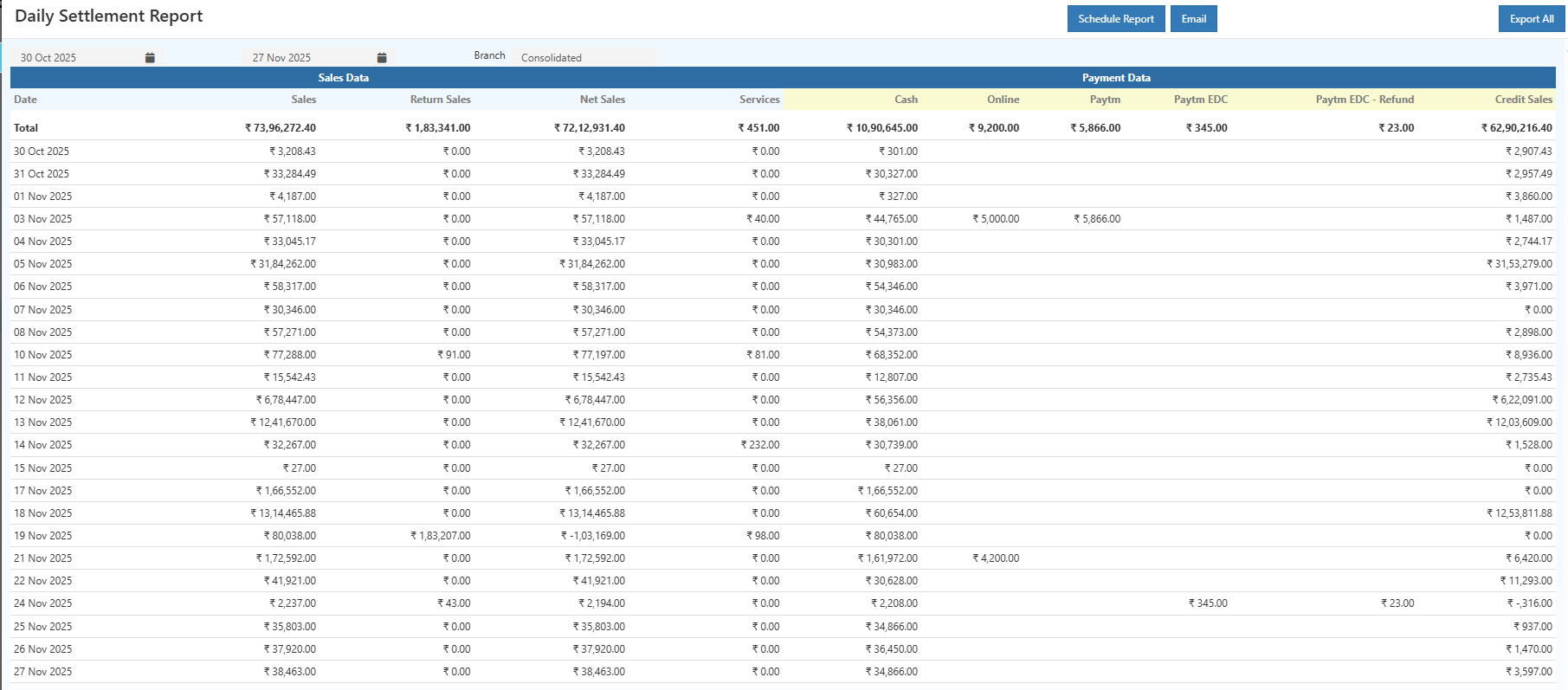

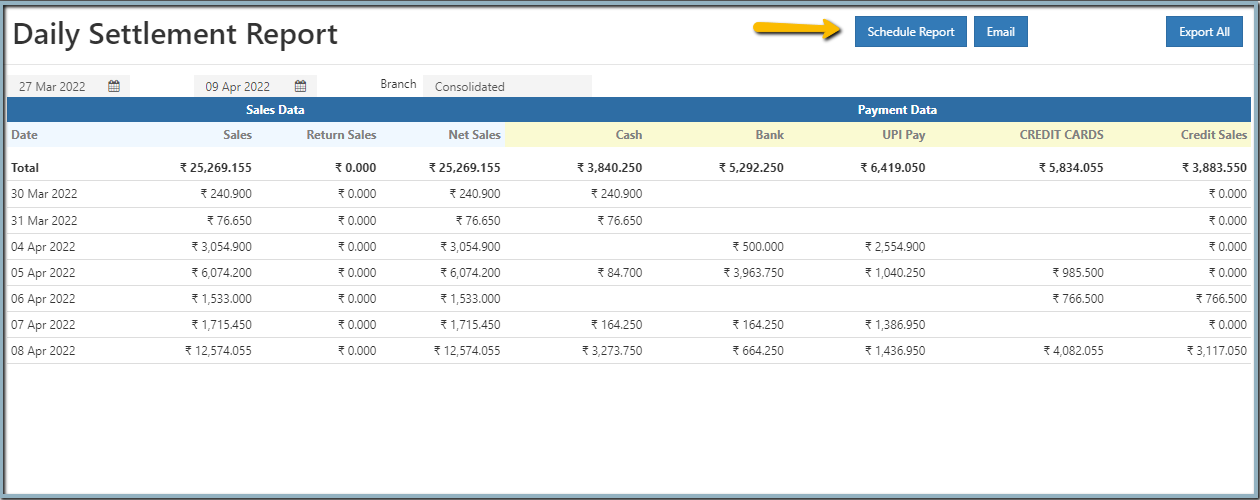

Viewing the Daily Settlement Report

Steps to access and review the Daily Settlement Report:

- Open Back Office.

- Click the Reports section or use the shortcut key Alt+R.

- Navigate to the Sales/Purchase Reports section.

- Click Daily Settlement Report. The report displays transactions for the current date.

- Adjust Start Date and End Date as required.

- The report automatically refreshes to reflect the selected dates.

Tip: The Export All option allows downloading the report in CSV format for offline record-keeping and accounting purposes.

Scheduling Reports for Automation

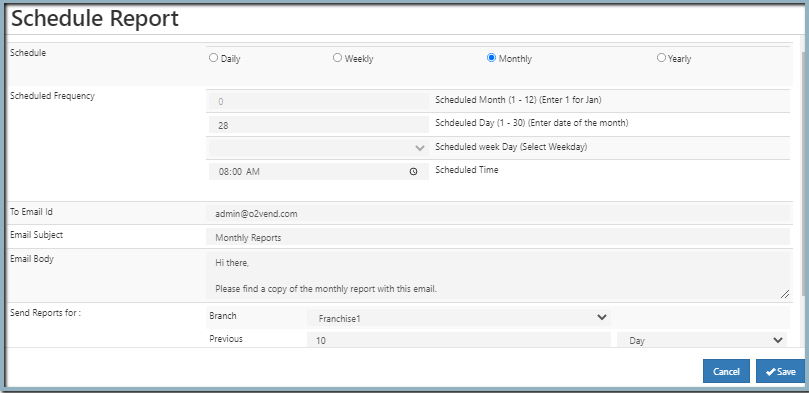

Scheduled reports can be configured to run daily, weekly, monthly, or yearly, and automatically send results to designated recipients. This feature ensures consistent reporting without manual intervention.

Click the Schedule Report button on the top-right corner of the Daily Settlement Report page to access scheduling options.

Scheduling a Report

- Enter scheduling criteria, including frequency, time, and recipient details.

- Complete the following fields:

| Option | Description |

|---|---|

| Schedule | Select the frequency of the report: Daily, Weekly, Monthly, or Yearly. |

| Scheduled Frequency | Fields adjust automatically based on the selected frequency. Daily reports run every day at the scheduled time; Weekly reports run on selected weekdays; Monthly reports run on the selected date; Yearly reports run on a selected month and date. |

| To Email ID | Enter recipient email addresses. |

| Email Subject | Define the subject line for the emailed reports. |

| Email Body | Provide the message body for the report email. |

| Send Reports for Branch | Select the branch for which the report data is applicable. |

| Previous Period | Specify the number of days, months, or years for historical data, if required. |

| Days/Month/Year | Define the range for the previous period selection. |

- Click Save to complete the schedule setup. The scheduled report will execute automatically at the selected time.

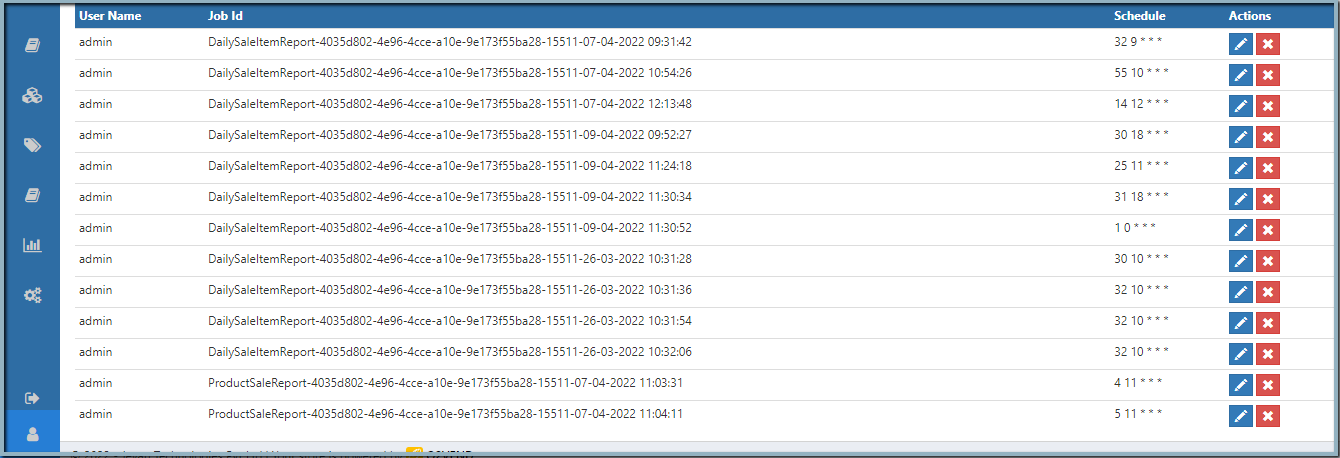

Profile Section: Managing Scheduled Reports

Scheduled reports appear in the Profile section of O2VEND Back Office.

- Edit a Scheduled Report: Click the edit icon to modify settings.

- Delete a Scheduled Report: Click the delete icon to remove the schedule.

Pro Tip: Scheduled reports should be reviewed periodically to ensure recipients and frequencies align with business requirements.

Benefits of Daily Settlement Reports

- Provides a complete view of sales, returns, and payments.

- Ensures financial transparency and effective cash flow management.

- Identifies discrepancies and reduces accounting errors.

- Supports automated reporting, saving time for finance teams.

- Facilitates audit and compliance adherence.