Chart of Accounts – Setup Guide and Examples in O2Vend

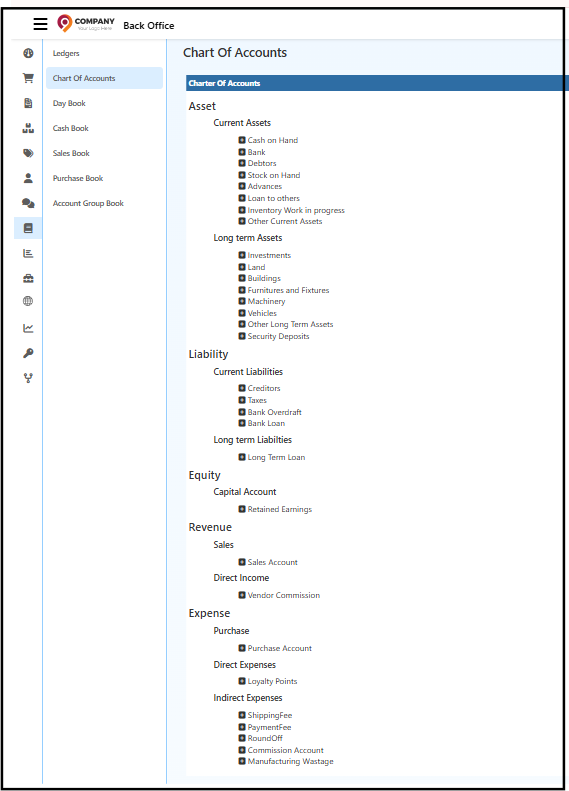

The Chart of Accounts is a structured framework in O2Vend that defines how all financial transactions are categorized and recorded.

It forms the foundation of accounting and reporting by organizing every transaction under a specific account type — such as Assets, Liabilities, Equity, Revenue, and Expenses.

Overview

The Chart of Accounts in O2Vend simplifies financial management by grouping related accounts.

This structured setup ensures clear tracking of company performance and helps in creating accurate reports such as Balance Sheet, Trial Balance, and Profit & Loss.

Account Structure

The system automatically categorizes master accounts into main groups:

Asset

Assets represent everything owned by the business.

Sub-categories include:

- Current Assets: Cash on Hand, Bank, Debtors, Stock on Hand, Advances, Loan to Others, Inventory Work in Progress, Other Current Assets

- Long-Term Assets: Investments, Land, Buildings, Furniture & Fixtures, Machinery, Vehicles, Security Deposits

Liability

Liabilities are the company’s financial obligations.

Sub-categories include:

- Current Liabilities: Creditors, Taxes, Bank Overdraft, Bank Loan

- Long-Term Liabilities: Long-Term Loan

Equity

Represents ownership interest and retained profits.

- Capital Account: Retained Earnings

Revenue

Tracks income generated from operations.

- Sales Account

- Vendor Commission

Expense

Represents costs incurred during operations.

Sub-categories include:

- Purchase Accounts: Purchase Account

- Direct Expenses: Loyalty Points

- Indirect Expenses: Shipping Fee, Payment Fee, Round-Off, Commission Account, Manufacturing Wastage

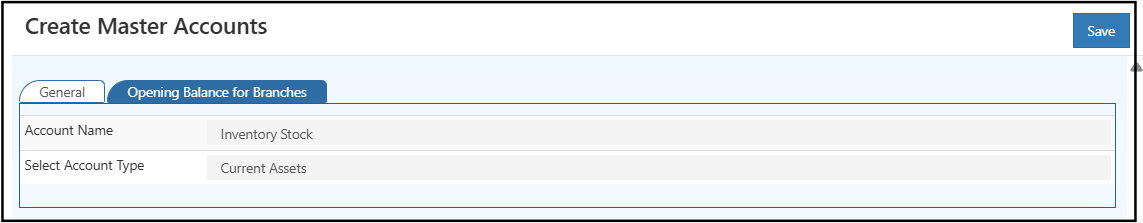

Steps to Create a Master Account in O2Vend

- Open Back Office.

- Go to Account Books → Chart of Accounts.

- Click Create on the top-right corner.

- Enter details such as Account Name and Account Type.

- Click Save to add the account to the list.

To edit an existing account:

- Select any account name.

- Update fields such as Account Name or Type.

- Click Save again to apply changes.

Benefits of O2Vend Chart of Accounts

- Maintains an organized financial structure

- Simplifies preparation of reports and statements

- Enables quick tracking of assets, liabilities, and profits

- Improves financial transparency and control

- Supports accurate tax and audit preparation

Note:

In financial systems, customers are often listed as Debtors and suppliers as Creditors to reflect the direction of money flow within business operations.